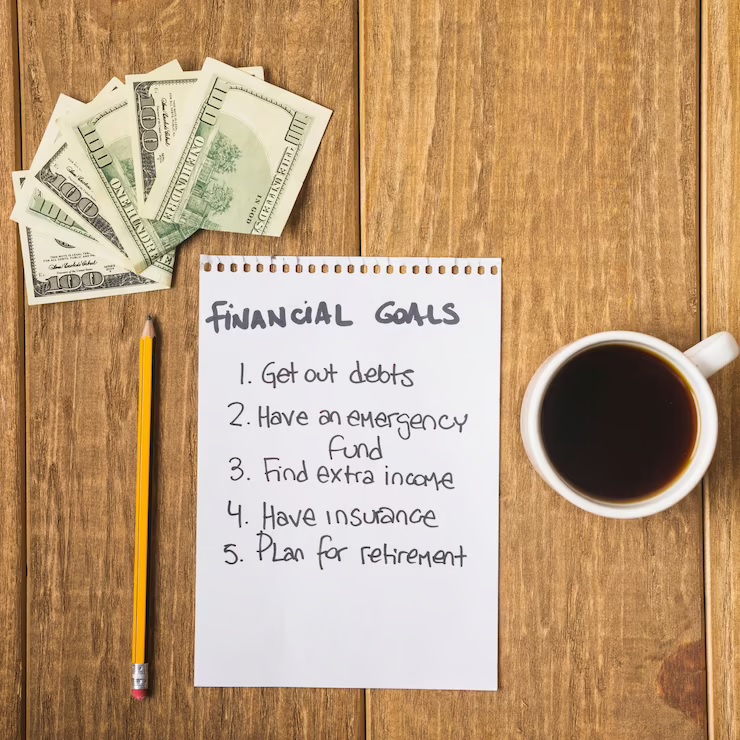

A financial goal is a specific, measurable, and achievable target that you set for your finances.

It can be short-term or long-term and can include both saving and investing goals. Some common financial goals may include:

Paying off debt: Many people set a financial goal to pay off high-interest debt, such as credit card debt, student loans, or car loans.

Building an emergency fund: An emergency fund is a savings account that can help you cover unexpected expenses, such as medical bills, car repairs, or job loss.

Saving for a down payment: If you plan to buy a home, you may set a financial goal to save for a down payment.

Saving for retirement: Retirement savings is a long-term financial goal that requires consistent contributions to a retirement account, such as a 401(k) or IRA.

Saving for a big purchase: You may set a financial goal to save for a big purchase, such as a car, a vacation, or a home renovation.

Setting financial goals can help you stay motivated and focused on your long-term financial success. It's important to create a plan that works for your individual needs and to regularly review and adjust your goals as your financial situation changes.

2 Comments